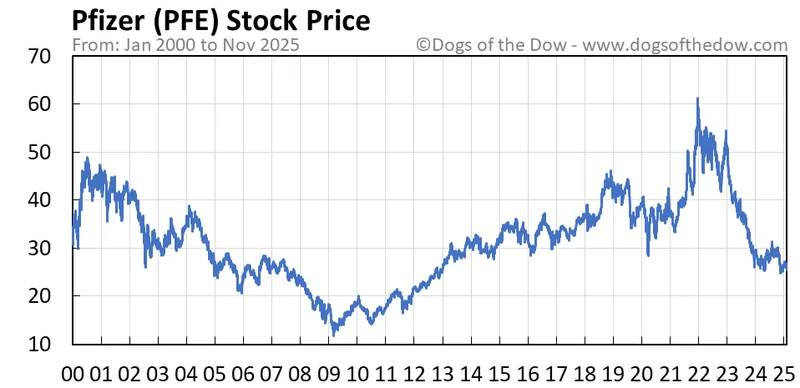

The market closed on November 10, 2025, with Pfizer (PFE) barely nudging the needle, up a meager $0.010 to $24.43. A fractional gain, yes, but hardly the kind of move that sends traders scrambling. For anyone paying attention to the pharmaceutical giant’s recent trajectory, this flatline feels less like an anomaly and more like a continuation of a rather sluggish narrative. The broader market, specifically the S&P 500, has been making modest gains, while Pfizer has spent the last month shedding 1.4% of its value. That’s not underperforming; that’s actively swimming against the current.

Yet, amidst this tepid performance, a curious whisper is growing louder in certain corners of the market: Pfizer, they say, is a "mean-reversion candidate." A compelling contrarian investment, ripe for picking. This isn't just a casual observation; it's a sentiment echoed by market analysts and institutional investors who are reportedly eyeing the stock for its historically attractive valuations. Pfizer Inc. (PFE) is Attracting Investor Attention: Here is What You Should Know - Yahoo Finance They see a company trading at a discount across multiple metrics—price-to-earnings ratios, enterprise value—compared to its industry peers. On paper, it sounds like a classic setup: a beaten-down blue-chip, ready for a rebound. But as I’ve learned from years staring at spreadsheets, what looks good on paper often has a few hidden wrinkles. My analysis suggests we need to peel back a few more layers before declaring Pfizer the next big comeback story. Pfizer (PFE) stock poised for potential turnaround - Rolling Out

Let's talk numbers, because that’s where the truth usually hides. Income investors, bless their hearts, are flocking to Pfizer's robust dividend policy. A quarterly distribution of $0.43 per share translates to a roughly 7.04% yield. In a world starved for reliable cash flow, that’s a beacon. Management’s commitment to consistent payouts, even through various market cycles, is a testament to its shareholder-friendly stance. It's a defensive play, a kind of financial sandbag against market volatility. And frankly, with the stock doing what it's been doing, that dividend is probably the only thing keeping some portfolios afloat.

But the dividend, while substantial, can sometimes act like a tether, preventing a deeper analysis of the underlying business. We’re expecting Pfizer to post current quarter earnings of $0.66 per share, which is a +4.8% change from the year-ago quarter. Sounds decent, right? Here’s where the nuance kicks in: the Zacks Consensus Estimate for this very quarter has decreased by 8.6% over the last 30 days. Think about that for a second. Analysts were more optimistic a month ago. This isn't a minor tweak; it’s a significant downward revision, even as the year-over-year comparison looks positive. It suggests a recalibration of expectations, which is rarely a bullish signal. For the full fiscal year, the estimate is $3.13, a modest +0.6% increase from the prior year, an estimate that has actually increased by 2.4% over the last 30 days. Conflicting signals, to say the least. And for the next fiscal year? The consensus is $3.14, a barely perceptible +0.3% jump, with that estimate decreasing by 0.4% over the past month.

What do we make of this seesaw of predictions? The consensus is a moving target, constantly adjusting. I often wonder about the methodology behind these "consensus estimates." Are they truly independent, or do they suffer from a herd mentality, slowly correcting in unison rather than leading? It's a valid question, given how quickly these numbers can shift. Technical indicators might show "higher lows" and "institutional accumulation," but if the underlying earnings picture is this volatile, those technicals might just be catching a falling knife.

Pfizer isn't just sitting still. They're actively engaged in cost-cutting initiatives and portfolio optimization strategies. This is corporate speak for "we need to tighten our belts and figure out what's actually making money." Their R&D pipeline spans multiple therapeutic areas, with upcoming updates and guidance revisions expected to be significant catalysts. Partnership opportunities and licensing agreements are also on the table. These are all good things, in theory. They represent potential avenues for value creation. But potential isn't profit.

The skepticism around traditional pharmaceutical companies post-COVID-19 isn't unfounded. The pandemic provided an unprecedented, temporary boost that's now cycling out. The market is struggling to re-rate these companies in a "normal" environment. This broader investor skepticism has indeed created "valuation opportunities" for contrarian positions, but a contrarian position isn't a guaranteed winner. It’s a bet against the prevailing sentiment. The question is, are you betting on a genuine value proposition, or merely hoping for a bounce from a company still figuring out its post-pandemic identity?

The market is a sea of information, and sometimes, the loudest voices aren't the most accurate. I've looked at hundreds of these "mean-reversion" plays, and while some pay off handsomely, others are just cheap for a reason. Pfizer's current market cap sits at approximately $138.90 billion, a behemoth by any standard, but even giants can stumble. Is the perceived discount a reflection of genuine undervaluation, or a fair price for a company navigating a complex transition? What specific catalysts, beyond the vague promise of "upcoming pipeline updates," are going to drive a sustainable, significant shift in investor sentiment? And how much of this "contrarian opportunity" is simply wishful thinking from those hoping to catch the bottom?

Pfizer is a Zacks Rank #3 (Hold), which means analysts aren’t exactly pounding the table for a buy. They’re saying, "wait and see." That's a reasonable stance. The company's recent beat on Q3 earnings by 32% is a positive data point, but it's a rear-view mirror metric. The forward-looking estimates, with their persistent downward revisions, are what demand attention.

The narrative around Pfizer feels like a classic chess game. The obvious move is to eye that dividend yield and the "discounted valuation," but a deeper look reveals a more complex board. It's not a clear-cut bargain bin find. It's a company with a strong foundation and a committed dividend, yes, but also one grappling with an uncertain growth trajectory and analyst expectations that seem to shift with the wind. Investors aren't buying a rocket ship; they're buying a battleship, slow and steady, designed for long voyages, not quick sprints. The question for any investor is whether they're looking for defensive stability or explosive growth, because Pfizer, right now, offers only the former, with a side of analytical uncertainty.